Credit card use is on the rise once more, as Americans use plastic to charge their purchases at an all-time high.

In fact, our total credit card balances increased by $887 billion in just the second quarter of 2022. Yikes!

That’s understandable given the rising cost of inflation, which has increased the cost of almost everything we buy on a daily basis, from food to gasoline to clothes and more. US households are incurring credit card debt in order to accommodate inflation and other economic instability.

However, our reliance on credit cards may come back to haunt us. With the Fed boosting its benchmark interest rate to combat inflation, one of the most significant consequences will be an increase in our credit card rates.

The great majority of credit card rates are variable, depending on the federal funds rate or some other financial indicator that rises or falls. And, with the Fed raising rates at such a rapid pace, guess who will see their credit card interest rate – and monthly payment – skyrocket as well? That’s correct – you!

And, with a considerable growth in credit card debt, the monthly payment increase is likely to affect consumers in the future.

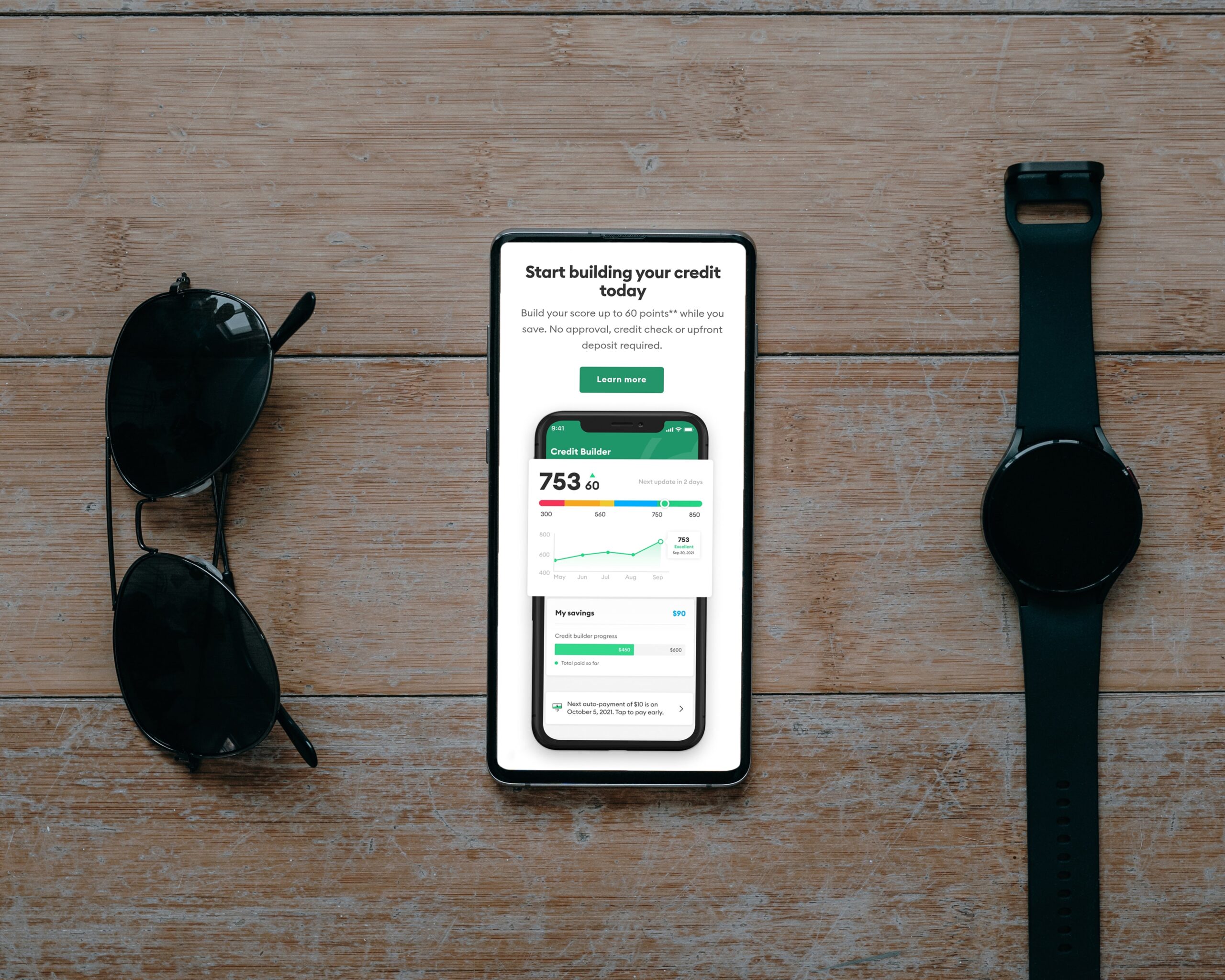

As a result, it’s vital that you take certain steps to safeguard your family’s finances. Of course, paying off credit card debt or reducing debt usage is crucial. However, in order to lessen the impact of increased interest rates, customers must also work on improving their credit ratings.

Today, we wanted to update you on the situation of credit card interest rates near the end of 2022 and heading into 2023.

The average credit card interest rate, according to Federal Reserve data, is 16.65%. (as of Q2 2022). While that is the average (and already quite expensive! ), different credit cards may offer significantly higher or lower rates. Remember that what actually matters is the APR, or Annual Percentage Rate, you’re paying.

When it comes time to make a credit card payment, how much might a credit score boost save you? Or, to put it another way, how much will your stubbornly poor credit score cost you over time?

Let’s take a look at data from the Consumer Financial Protection Bureau’s The Consumer Credit Card Market study, which is updated every two years.

(FICO Scores, the most common credit scoring model, range from 300 to 850.)

As you can see, a below-average credit score translates into much higher credit card rates.

It’s also worth mentioning that the majority of the data in this research comes from 2020 or 2021, when credit card rates were normally substantially lower.

In reaction to Fed rate rises, consumers can and should expect interest rates on this charge to rise dramatically in 2023.

Other CFPB report findings: Premium credit cards typically have a higher APR; airline and travel cards have a higher interest rate; cash back credit cards typically have higher interest rates than the average credit card, but less so than cash back reward cards; and credit cards popular among (and geared toward) college students have higher-than-average interest rates.

Also, keep in mind that these interest rates and APRs only apply if you have an outstanding debt. If you pay off your purchases and charges on time each month, you will avoid the large financial cost of paying interest on your balances.